The OP&F Board of Trustees believes that having good health in retirement requires access to good health care insurance. Although support for retiree health care is a discretionary benefit and not a vested right from OP&F and is subject to change at any time, Trustees recognize it as an important part of a dignified retirement and have elected to subsidize health care. OP&F provides eligible benefit recipients with a stipend based health care program and collaborates with vendor experts Alight Retiree Health Solutions and Your Spending Account (YSA) to administer a Health Reimbursement Arrangement (HRA), which is funded by OP&F and is available to these members through the HRA to be used to reimburse retirees for qualified health care expenses.

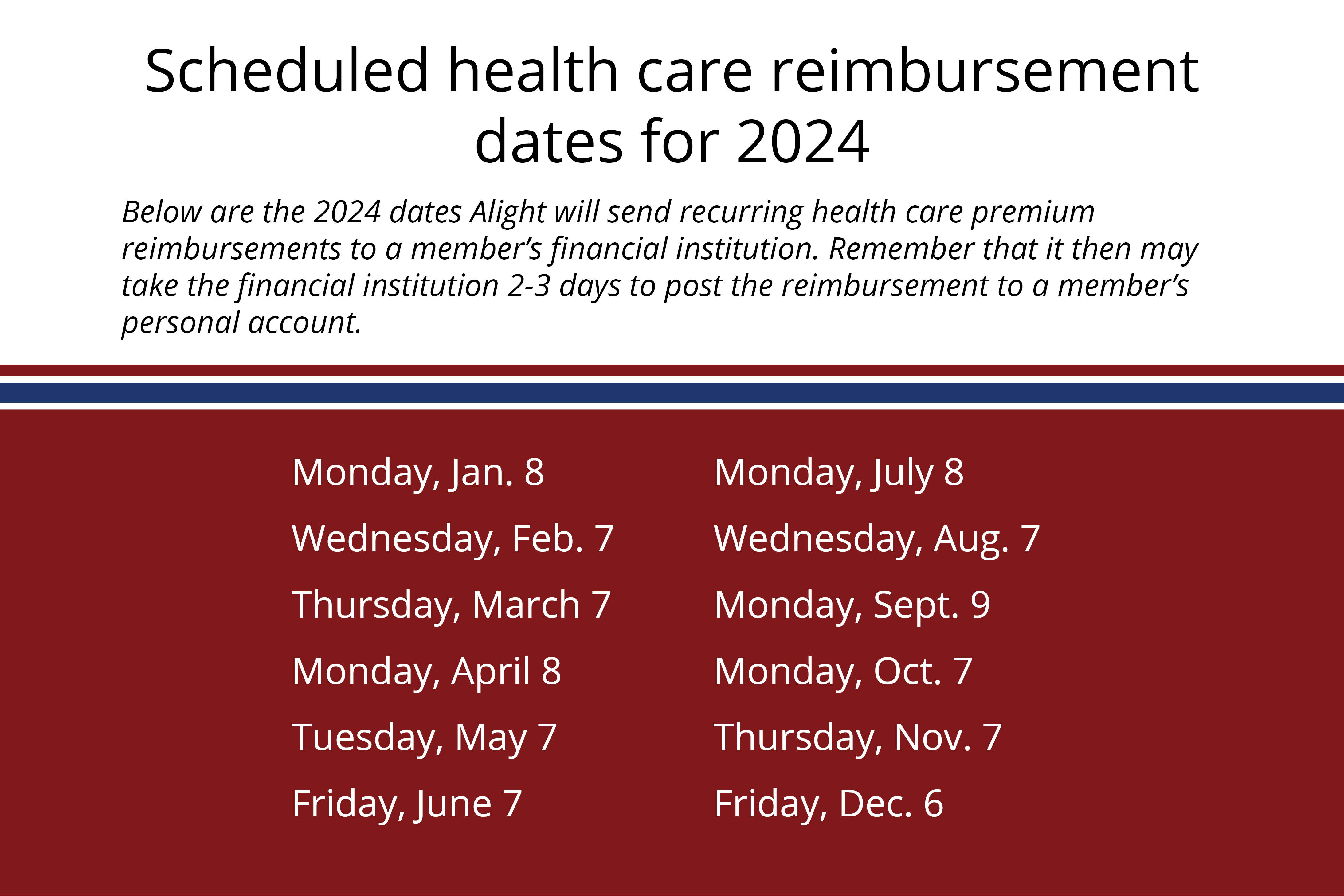

The latest information concerning retiree health care is featured below. Additional information from our health care partner, Alight Retiree Health Solutions can be found at a special website for OP&F members.

Important contact information:

1-844-290-3674, Monday – Friday,

1-844-290-3674, Monday – Friday,9 a.m. – 9 p.m. Eastern Time

Alight website for OP&F retirees

myexchangeconnection.com

Eligibility

A retiree is eligible for the OP&F health care stipend unless they have access to any other group coverage including employer and retirement coverage, or have previously waived coverage. The eligibility of spouses and dependent children could increase the stipend amount you are eligible to receive. If the spouse or dependents have access to any other group coverage including employer or retirement coverage you are not eligible for increased stipend support from OP&F. Even if an OP&F member or their dependents are not eligible for a stipend, they can use the services of Alight to select and enroll in a plan.

When you submit a Service Retirement Application or a Disability Benefit Application, members must also submit the Health Care Stipend Eligibility form, included in your retirement packet, along with proof of enrollment in an eligible health care plan. To receive the OP&F health care stipend, new retirees must enroll in eligible health care and/or prescription drug coverage within 60 days of losing access to health care from their employer. If more than 60 days elapse, the member must have a Qualifying Life Event (QLE) to again become eligible for the stipend. An eligible plan can be through Alight, COBRA, or a qualifying policy through a broker or healthcare.gov.

For OP&F members, a QLE must occur to enroll and to be eligible for a stipend. Other common QLEs include marriage (pre-Medicare only), divorce, at the time of Medicare eligibility, birth or adoption of a child and death.

Once OP&F receives the Health Care Stipend Eligibility form and confirms your eligibility for the stipend, it will take approximately three to four weeks for Alight (OP&F’s health care partner) to send out a welcome packet detailing information about enrolling in a health care plan and using your stipend to help pay for the plan. OP&F will notify the member if they are not eligible for a stipend.

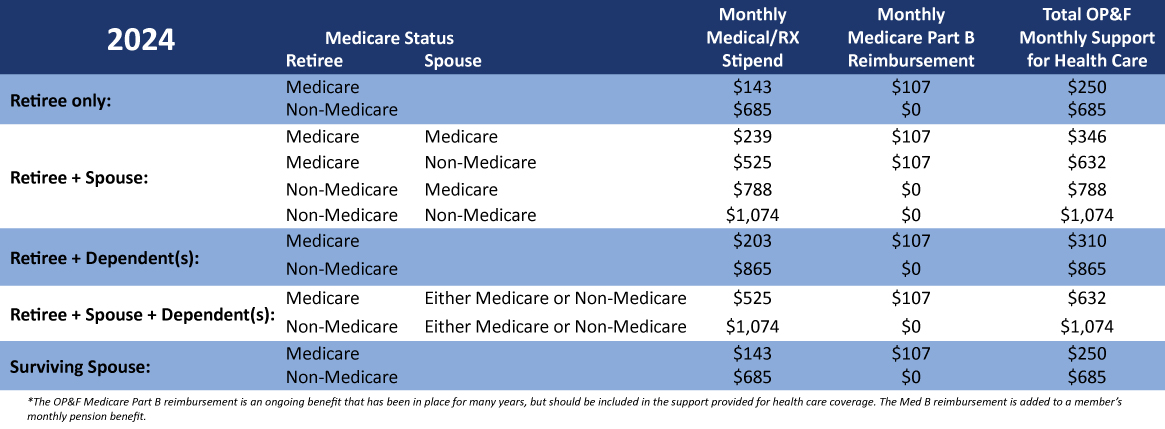

Health Reimbursement Arrangements

A single HRA will be available to the member, regardless of the stipend amount and number of participants enrolled in a plan. The HRA will be in the member’s name, but all eligible participants may submit claims. The stipend will be prorated based on the Medicare status of you and any eligible dependents, your month of retirement and the effective date of enrollment. An annualized amount will be provided for use during subsequent years. At the end of the year, any amounts not used will be forfeited. However, participants will receive a full annual stipend amount each Jan. 1.

Members should be aware that once they enroll with a health care provider, a premium payment may be required. Reimbursement for this premium through your HRA may not be available for several weeks.

Qualifying Life Events (QLE)

If you experience life changes outside of the open enrollment period you may qualify for a Special Enrollment Period. However, these qualified life events may be different for Medicare and non-Medicare plan enrollees. Qualifying life events include:

- At the time of your OP&F retirement and loss of your employer group coverage within 60-days;

- Marriage (pre-Medicare only) as long as the member or spouse had coverage 60-days prior;

- Death or divorce resulting in loss of group coverage;

- Involuntary loss of group coverage

- Involuntary loss of individual coverage due to plan ended contract with Medicare/Affordable Care Act;

- At the time you become eligible for Medicare;

- Loss of premium assistance for member or dependent child under a Medicaid plan or Children’s Health Insurance Program (CHIP);

- Loss of Medicaid or CHIP coverage for member or dependent child;

- Moving out of service area;

- Becoming a dependent as a result of birth or adoption;

- Plan renewing outside of enrollment period;

- Becoming a U.S. Citizen;

- Income increase that moves out of poverty level;

- Income changes that make a person newly eligible or ineligible for premium tax credits or cost-sharing subsidies, if already enrolled in the exchange; or

- Native Americans\Alaskan Natives as defined by the Indian Health Care Improvement Act.

Pre-Medicare Enrollment

As you transition from your employer’s group health care plan you will experience an involuntary loss of group coverage, which is considered a qualifying life event (QLE). You must notify OP&F in writing within 60 days of the QLE and provide proof to OP&F. If you fail to do so, you will lose eligibility to receive the stipend and will have limited opportunities to participate in the future.

PreMedicare retirees must enroll in an Individual or Family major medical qualified health plan that is compliant with the rules of the Affordable Care Act (ACA) and contains the ten essential benefits and prescription drug coverage. Employer or group sponsored plans, short term plans, Christian Ministry and group share plans and non-accredited ACA plans are examples of plans that do not meet eligibility for a member to receive the stipend.

Once the welcome packet information is received from Alight, members who are not yet eligible for Medicare can create an account with Alight and shop for plans on the Alight website which is customized for OP&F retirees.

You have the option to enroll through Alight, COBRA, healthcare.gov, or any independent broker within 60 days of losing access to your employer’s group health care plan. To enroll in a plan through Alight, OP&F members should follow the path for enrollment from the Alight website. The below information is strictly for modeling purposes.

If you are not yet retired and under age 65, you can see examples of plans and premiums by following these instructions. These are examples only.- Go to health coverage resources

- Selected Early Retiree Plans

- Click on the federal subsidy Coverage Calculator

- Answer the questions but

- say No to the cobra coverage question

- Under qualifying event select Loss of Coverage

- And for the Special Enrollment Date field, the date entered cannot be more than 30 days out

- It will then tell you you’re not eligible for a federal subsidy and then click on See Plan Options

- It transfers you to Alight

- You will now see plans

Medicare Enrollment

Retirees who are 65 years of age or older must be enrolled in Medicare Part A and Part B and provide OP&F with a copy of your Medicare card. This is also necessary for early Medicare recipients. If OP&F determines that you are eligible to receive the stipend, you must enroll in health care plan and/or prescription drug plan through Alight within 60 days of Medicare eligibility or losing access to your employer’s group health care plan. If you enroll in a plan outside of Alight you will become ineligible to participate in OP&F’s health care program and will need a qualifying life event to become stipend eligible in the future. Medicare-eligible members will receive information from Alight to have a scheduled phone appointment with an Alight benefits advisor who can assist you in what plans are available to supplement your Medicare coverage. To contact Alight, please call 1-844-290-3674.

COBRA

Enrollment in COBRA

At the time of your retirement, non-Medicare participants will probably have the option of continuing on your employer’s health plan for at least 18 months, thanks to a federal law called the Consolidated Omnibus Budget Reconciliation Act (COBRA). Please contact your current employer to learn more about your COBRA options. If you enroll in COBRA, you will be eligible to receive the OP&F stipend while maintaining your COBRA plan until the next OP&F annual Affordable Care Act (ACA) enrollment period or until the expiration of your COBRA plan, whichever you prefer. However, you must enroll in an Individual or Family ACA accredited major medical qualified health plan through Alight, or any independent broker within 60-days of your COBRA expiration and be continuously enrolled thereafter to continue to be eligible for OP&F’s stipend.

OP&F will prefund an Alight Health Reimbursement Account (HRA) while you complete enrollment in COBRA. To remain stipend eligible, you must submit a copy of your COBRA acknowledgement letter to OP&F along with the following documents:

- Documentation from the COBRA carrier which includes the name of the plan enrolled in;

- Names of the participants enrolled in the plan;

- Effective dates of coverage for the enrolled participants in the plan;

- OP&F’s Health Care Stipend Eligibility form.

OP&F will acknowledge receipt of the form and request any additional documentation that may be required.

After COBRA

Approximately 90-days prior to the expiration of your COBRA plan OP&F will contact you requesting proof of enrollment in an Individual or Family major medical qualified health plan that is ACA compliant and contains the ten essential benefits purchased through Alight Retiree Health Solutions, healthcare.gov or any independent broker. The plan you chose must be an ACA accredited plan. To continue to be eligible to receive OP&F’s stipend you must submit proof of the new enrollment to OP&F along with the following documents:

- Documentation from the new carrier which includes the name of the plan enrolled in;

- Names of the participants enrolled in the plan;

- Effective dates of coverage for the enrolled participants in the plan;

- OP&F’s Health Care Stipend Eligibility form.

To make the transition from your COBRA plan a smooth one, Alight can help you compare plans, get answers and assist in selecting and enrolling. If your COBRA plan is terminated before the 18-month period has elapsed you must provide OP&F with proof of enrollment in an ACA accredited major medical qualified health plan within 60-days of COBRA termination. You must also contact Alight to adjust any auto premium reimbursements you may be receiving. You are responsible for any overpayments.

However, if you enroll in a plan through the insurance marketplace you must submit proof of coverage to OP&F and you will no longer have advocacy through Alight with claim problems or other carrier issues.

Disability Applicants

Disability applicants are encouraged to apply for COBRA coverage through their employer for health care. Once employment ends there may be a gap between when the employer’s health care coverage expires and eligibility to enroll in a plan through OP&F. Obtaining COBRA coverage will prevent a lapse in coverage while a disability application is being considered. COBRA premiums are also a stipend-eligible expense.

To qualify for a stipend from OP&F you must become eligible for the OP&F health care stipend during the next open enrollment period. If you do not become eligible during the next open enrollment period, you will need to remain on COBRA until the contract period ends.

If you have questions regarding this information, please contact an OP&F Customer Service Representative at 1-888-864-8363, Monday through Friday 8:00 a.m.-4:30 p.m. ET.